What Happens If I Ignore Debt Collectors And My Debts

Let's Just Ignore Them! They Can't Do Anything About It Anyway

Can they? I'm sure there's plenty of us who've got fed up paying now for money we spent long ago and have thought 'what would they do about it if I just stopped?' Of course we'd receive the angry notices, the phone calls in the evening but what if we just said no to everyone. I was curious so I researched it. The law doesn't hate us and side with big businesses believe it or not. In the UK at least there are a lot of 'consumer rights' laws designed to protect us plus a whole load of bodies which monitor money lenders and even more pressure groups just waiting for their chance to declare banks as evil. That said we have to play fair. If we were all to borrow money and never give it back the banks would collapse and take every bodies savings and pensions with them, as well as the economy so of course there are laws to help them too. Besides that the UK economy is built on debt, us borrowing so that we can buy and pump in tax to the government.

The Law For The Lender

Before any deal is done the lender (ie the bank, credit card company etc) must explain to you: If there is anything the credit can't be used for, how much you will pay back periodically (each payday) and in total over the whole life of the loan, any features which may in the future make things worse for you that you are not expected (because you're not a financial genius) to be able to anticipate (such as costs going up if the Bank of Englands rates go up) and any circumstances where they can cancel and demand their money back. If by chance some of this wasn't done perhaps you could seek advice on challenging it.

What Are My Creditors Going To Do?

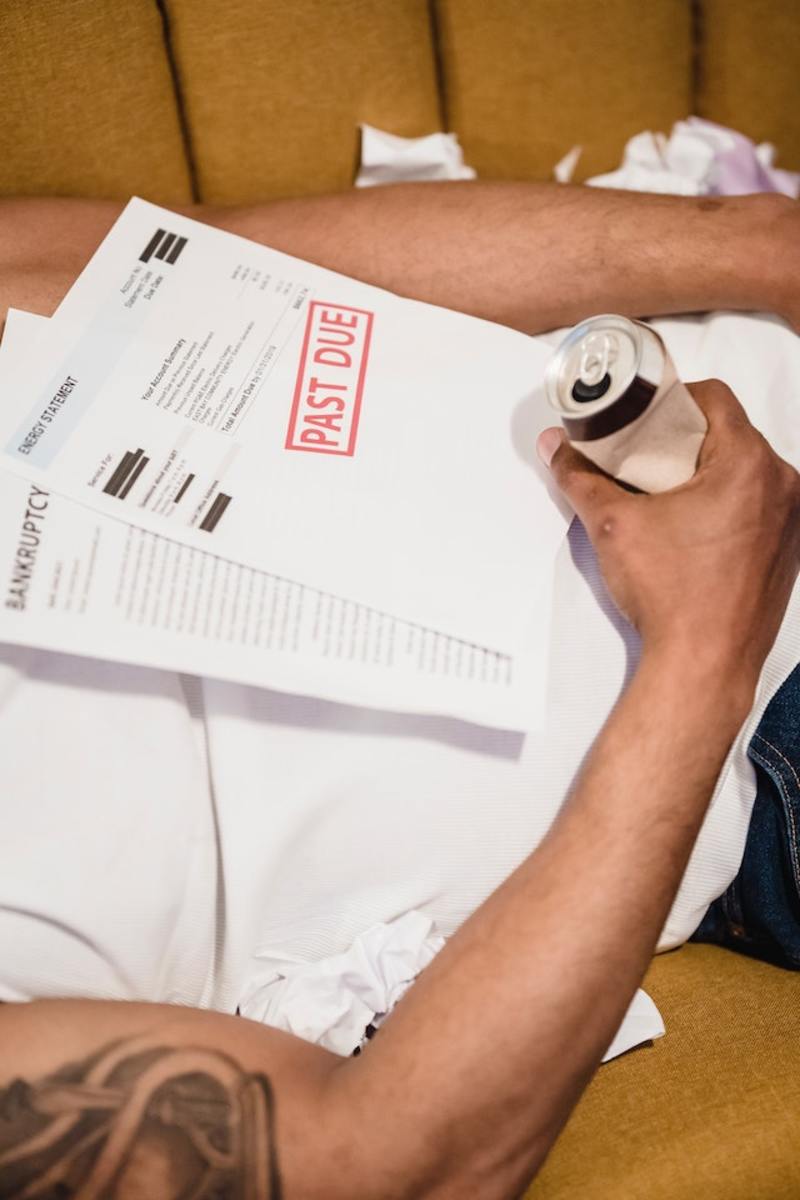

You've now stopped paying. So what's going to happen? Well as you probably already know they're going to continue adding interest on what you owe and you're also going to have late/missed payment fees on top of this. The fees and interest they add on would have been on your initial contract you signed, if it wasn't or they've charged extra you can challenge them to give it back. On top of this every time they send a letter or phone you they'll charge a fee to cover their costs. This will all get piled onto your debt. After a few missed payments they'll assume you're not going to pay and they'll sell your debt to a debt collection agency who will continue with the letters and phone calls and probably become really quite threatening. The phone calls however you don't have to listen to if you find them upsetting or frightening. It's also worth knowing that when they threaten to take you to court, it's very expensive for them to do so and they will quite often accept a reduced payment from you especially if you can show them you genuinely can't afford to pay.

Do you worry about debt when in bed at night?

What Can't My Creditors Do?

There a number of things your creditors can't do. They can't call you or make a personal visit at your place of work, they can't discuss your debt with your family, friends or most relieving, your employer. They can't insist you borrow more money so as to be able to pay them and, if you're in the middle of making an agreement with them, they can't continue to bother you during this. They also can't lie and make out they have legal powers which they don't. If they do any of these things you should make a complaint to them in writing also asking them to stop any further action until your complaint is resolved. Also let them know if it is not resolved satisfactorily you will contact The Financial Ombudsman.

If You Still Ignore Them

They can apply to a court to make you pay. If you respond to the court you can argue your case on how much you can afford. If you do not then the court automatically issues a County Court Judgement ordering you to pay at the rate the creditor has requested. If you don't then the creditor can request from the court a few things. They can ask permission to send round the baliffs or ask for an attachment of earnings order. This is bad news. You will receive a form you will have to fill in and return or you will receive a court summons. And as we know not turning up for court lands you in trouble. The attachment of earnings order means a portion of your salary goes straight to your creditor. Also meaning your employer finds out about all of this. They can also apply to make you bankrupt, and all you legally have to owe them is...£750. Then anything you own of value is sold. House, car anything until they've been paid in full. Once courts get involved you are also responsible for many of their fees. It probably doesn't even need mentioning what this will all do to your credit file as well and we as a nation live on credit.

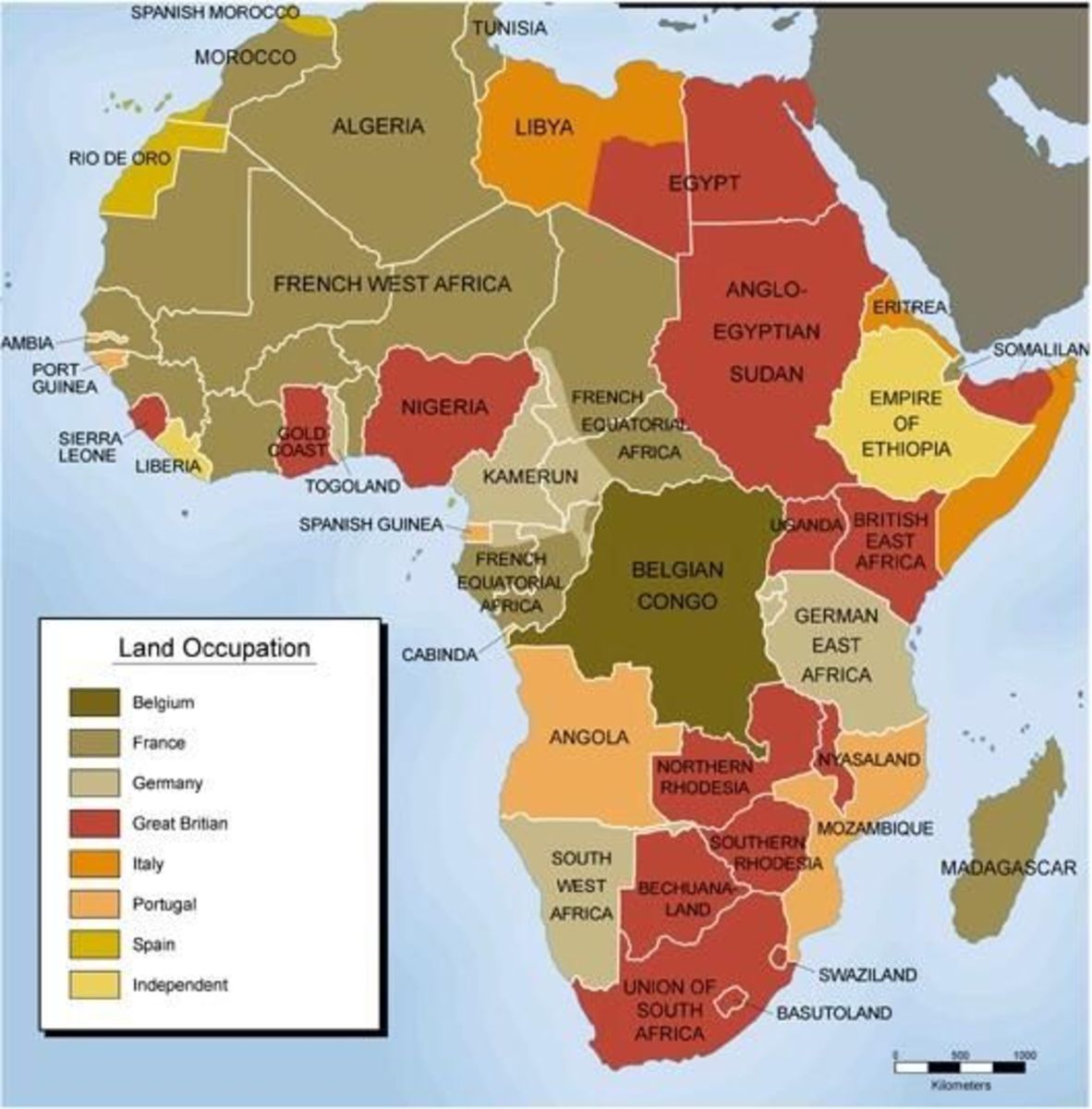

So Can I Get Away With It?

My grand conclusion then. Can I get away with hiding from my debts? Don't know. It all depends how bad those creditors want their money back. If they want it then short of skipping the country or faking your own death (perhaps by pushing your kayak out to sea) then you really can't. Speaking to other people it seems the best way is either to speak to a debt management company who, for a fee, will arrange affordable payments or speak to them yourself. If you genuinely can not afford to pay offer them something to leave you alone. Offer them the choice to take it or leave it. Take it or drag you through court. I know people who this has worked for. Just be ready to go back on your threat if they refuse, you really don't want your house being sold to pay a £750 debt. Must be real tempting to push your kayak out to sea now.